New Passive Investment Opportunity!

* Accredited Investors Only

Invest In A Professionally Managed, Vertically Integrated, Self-Storage Fund

Fund offers income potential plus potential real estate profits

Focused On Properties In High-Growth Markets

Historically Recession Resistant Asset Class

Low Tenant Turnover With Minimal Management Required

Why invest with US?

Why invest with US?

Invest in the future of self-storage with our vertically integrated investment fund, specifically designed for emerging markets in the southeast. Experience never-seen-before features that ensure the safety and security of our investors’ interests, including onsite management teams, electronic gate access, digital security surveillance monitoring, and well-lit corridors. Don’t miss out on this opportunity to invest in a cutting-edge self-storage solution that will provide stable and predictable cash flow for years to come.

12-18%

AVG. Annual

Returns

1.5X-2.0X

Targeted Equity

Multiple

Management

Management

6 REASONS WHY TO INVEST IN SELF-STORAGE?

6 REASONS TO INVEST IN OUR SELF-STORAGE FUND

Minimum Investment

$50K

Annualized Returns

12%-18%

Monthly Cash Flow

6%

Targeted Equity Multiple

1.5X-2.0X

Split of Cash Distributions:

Tiered Structure

Fund Holding Period

5-7 years

Investment Structure

A Capital Structure That Places Our Investors First

Storage Units Equity Income Fund, LLC is managed and advised by Storage Units Capital Management II Corporation (“SUCMIIC”) and its affiliates, which intend to invest in affiliated entities which acquire, develop, redevelop, or repurpose other real property into self-storage facilities ranging from $5 million to twenty million dollars. The fund allows our investors to spread risk over a diversified portfolio of Self-Storage facilities while providing the opportunity to earn regular income. Our focus is on mitigating risk.

Our simplistic Structure aligns the economic interests of the sponsor and our investors.

OUR RECENT ACQUISTIONS

CURRENTLY IN THE PIPELINE

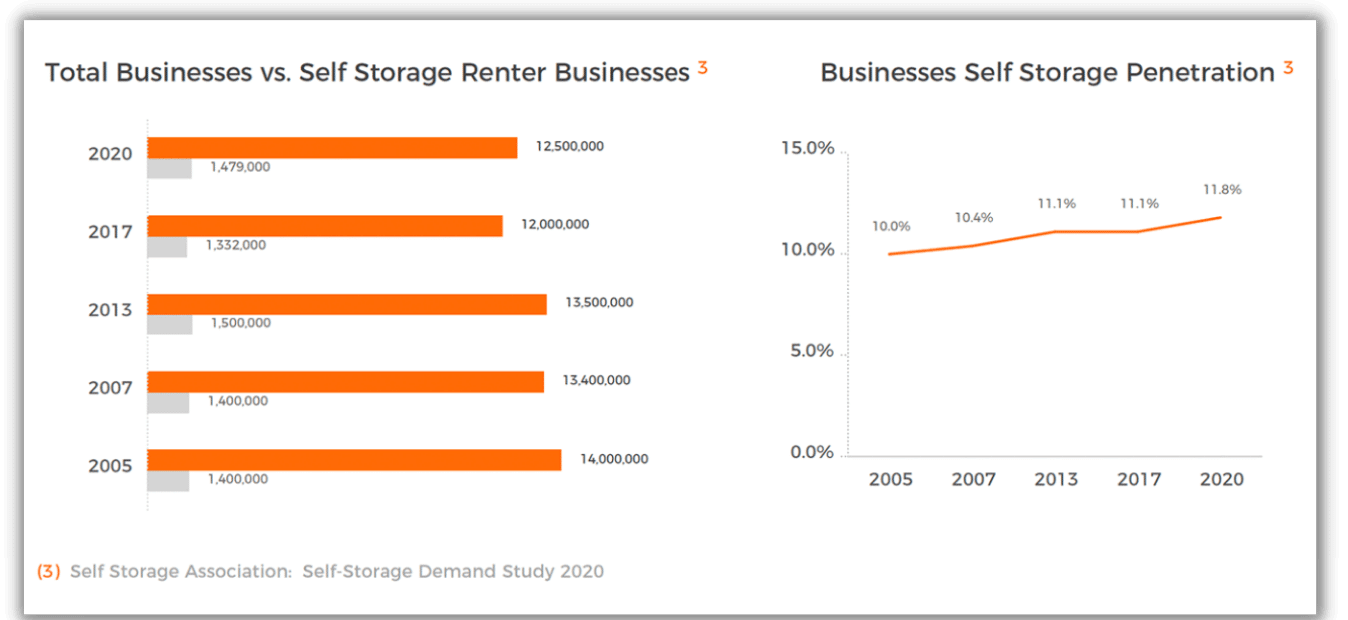

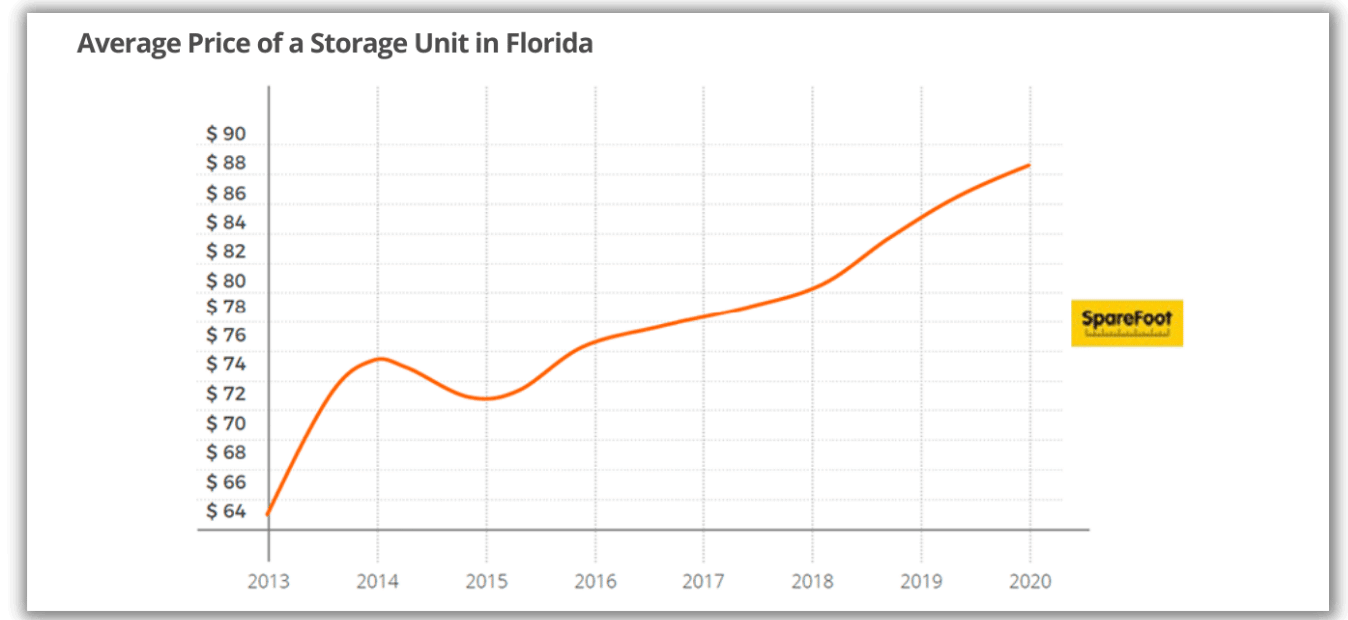

What does Self Storage offer

to an investor?

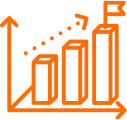

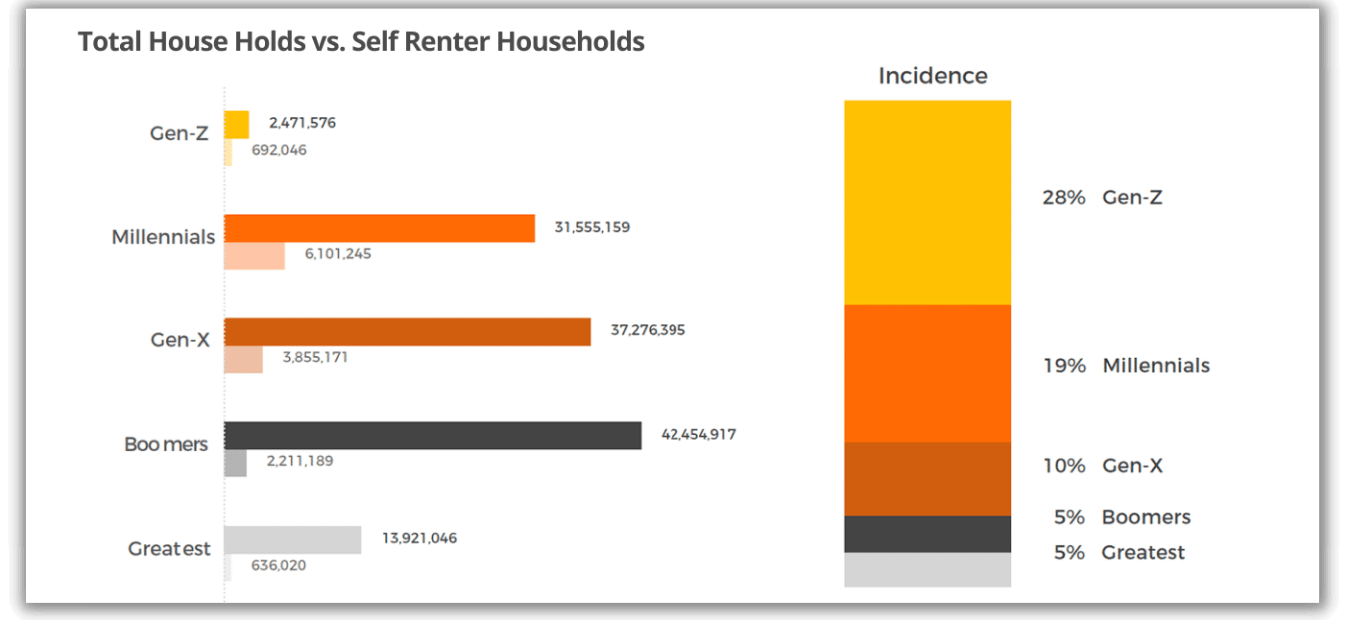

Americans love their stuff. But younger Americans REALLY love their stuff!

Self-Storage Unsophisticated & Undermanaged

74%

of Facilities are Owned by Small,Unsophisticated Operators

StorageUnits is built to take advantage of this industry fractionalization through a stronger brand defined by

Onsite Management Teams

Electronic Gate Access

Digital Security Surveillance Monitoring

Well-lit Corridors

Lack of Institutional Competition Drives Opportunity

A Vertical Story

Our TEAM

The StorageUnits team believes self-storage to be an attractive strategy for creating favorable risk-adjusted returns for investors with downside protection. With the ability to dynamically manage revenue and efficiently scale management systems, self-storage is a viable alternative to other real estate strategies.

Richie Webster

CEO/Owner, Rapid Building Solutions, LLC

CEO/Owner, Rapid Construction Solutions, LLC CEO/Owner, Storage Units, LLC

Richie Webster

Summary Richie Webster is president and owner of Rapid Building Solutions, LLC, an all-inclusive Design Build company specializing in self-storage facilities; as well as specialty buildings like indoor sports facilities, airplane hangars and roofing.

The New Zealand native left Auckland for the United States in 1993, in search of new opportunities. Since arriving, he has garnered success by combining hard work, determination, entrepreneurship, and a willingness to take a few chances.

What started as a company of five in 2016, Richie has built Rapid Building Solutions, LLC into a robust corporation featuring 326 employees while building 5-6 million square feet of self-storage per year. Today, RBS builds storage facilities for major brands and accounts across the United States such as Bee Safe, Extra Space, Cube Smart, Life Storage, Monster Storage, etc.

Storage Units, LLC was formed in late 2014 and has more than 26 sites under different phases of construction nationwide, and plans on opening 2 million more square feet from now and the end of 2021.

Career HighlightsInitially landing in Los Angeles, CA, Richie started his construction career as a labor steel erector with Farrell Construction, spending six years building self-storage facilities across the United States. He rose quickly through the ranks, becoming a senior project manager within two years while also managing projects nationwide.

In 2001, Richie was tasked with building a four-story project in Orlando, FL for Sure-Guard. During that time, he had his first child and ultimately settled permanently in central Florida. He also set off to start the first of his own companies, leaving Farrell Construction to create Pro-Tek Construction, LLC. Pro-Tek began by subcontracting Installation Services for major self-storage suppliers. Over the next seven years, Richie built the company to a peak of more than 250 employees with sales of $6-8 million annually. One client, Rabco Corp, dedicated all of its projects to Pro-Tek. That enabled Pro-Tek to stay strong during a drastic national economic downturn. During those trying times, Richie also effectively restructured the company and fine-tuned the costs, enabling Pro-Tek to earn even higher profits. Pro-Tek Construction installed more than 58 million square feet of self-storage before the sale of the company in 2018.

In 2012, Richie met Danielle Gavagni, his future wife. Together they purchased their first storage property in Apopka, FL in 2014. Using his years of hands-on experience, industry knowledge and business acumen, they built a profitable self- storage facility and set the stage for continued growth in the storage industry. Together, Richie and Danielle designed, created, and developed a unique Storage Units brand.

The Storage Units brand has since transformed into multiple companies carrying the name. The ongoing vision for the Storage Units brand is to build 10-20 new self-storage facilities nationwide per year. In one year, they have sold four operating facilities for $25 million, netting $8 million. As of 2020, Storage Units has four facilities open, seven under construction, six in for permit, three at the engineering phase, and five under contract in the due diligence stage.

By 2016, Richie became a founding member of Rapid Building Solutions (RBS). In 2018 he sold his labor company, Pro-Tek, to RBS for $5 million and under his leadership, RBS immediately turned sales of $30 million in its first year. With the addition of Pro-Tek labor, RBS was able to utilize its own assets and manpower to build and sell projects quickly, providing an ability to capitalize new projects.

Rapid Building Solutions now turns sales between $70 million and $80 million annually, and has built around 16 million square feet of self-storage and counting.

In 2020, Richie became a founding member of Rapid Construction Solutions; a company that was created to take on the role of General Contractor (GC) for all Storage Units branded storage facilities. RCS is immediately set to turn sales of $70 million in its first year with contracts from its sister company, Storage Units. RCS holds multiple GC licenses in multiple states across the east coast of the United States.

Richie has built excellent relationships with financial institutions such as Chase, Citizen’s, Truist, Mid Florida, First National Bank of Mount Dora, Morris Bank, and many others. The storage industry continues to be an essential part of the Rapid Building Solutions success.

PersonalRichie lives in central Florida with his wife, Danielle, son and two Doberman Pinschers. When he’s not working, he enjoys boating, watching the New Zealand national rugby team – the All Blacks, and traveling to his vacation home in The Bahamas.

William N. (Bill) Johnston

Bill serves as Storage Units Capital Group Chief Investment Officer and CFO, heading up financial services, responsible for institutional investor relations and capital allocation.

Over the course of his career Bill has raised and invested more than $2 billion of capital in various forms ranging from private equity to structured debt. He brings deep rigor and discipline to our team based on his extensive multi-sector institutional real estate investment, development, and operations experience.

Bill’s domestic and international leadership background leading high-growth teams as a strategic partner to Fortune 50 companies brings highly relevant growth expertise to our mission. Prior to joining our team, Bill served as Chief Investment Officer at Unicorp National Developments, a leading developer of retail, mixed use, and multifamily properties, EVP Corporate Development and Interim Chief Operating Officer at Digital Risk, LLC, where he delivered over $11 million of annual operating margin growth through operational improvements and supported the 2012 sale for $175 billion to Mphasis Ltd., (an HP Company), and Chief Operating Officer at Liberty Investment Properties, Inc., where he created and led national hotel development platforms in partnership with Goldman Sachs and Angelo Gordon.

Bill started his public accounting career as a financial modeling specialist and IT systems specialist at PriceWaterhouse Coopers, LLC. He has held various global C-level roles which include North American Chief Operating Officer, Managing Director of Global Financial Services, and head of North American Real Estate for publicly-traded London-based global third-party logistics outsourcing provider, Tibbett & Britten Group, plc driving the growth of its North American operation from a startup to over 11,000 team members handling $35 billion of goods annually.

Bill holds an Executive MBA from Harvard University, Master of Accountancy, and Bachelor of Commerce degrees from McGill University. He is a Certified Public Accountant (Illinois), and Chartered Professional Accountant (Canada). Bill also holds a FINRA Series 79 Investment Banking Representative License and Instrument Rated Private Pilot’s License.

Wayne Broderick

Wayne is 48 years old and resides in Orlando, Florida with his wife, son, and daughter.

With 23 years of experience in the self-storage industry, Wayne has developed many relationships within the industry, including developers, owners, engineers, and industry experts.

Wayne was raised in Cape Town, South Africa and came to the US to attend college. He eventually found his way into sales within the self-storage industry throughout the southeastern United States, attending quarterly and annual events with other industry leaders / experts and growing into building / developing hundreds of storage projects. Prior to Rapid Building Solutions, Wayne was President and owner of Express Building Systems…a company that built, developed, and designed storage facilities throughout the South East and Mid-Atlantic United States.

During this tenure, Wayne was instrumental in the completion of over 15 million sq. ft. and 400 storage facilities. He became Vice President of Rapid Building Solutions in 2016, assisting Francis Webster, Owner and President with the construction of projects and building the clientele that would help grow Rapid Building Solutions industry wide. In the last couple of years, Wayne has become owner / developer in Storage Units, a newly created brand, in several self-storage facilities throughout the east coast and continues to search for new investment opportunities in self-storage.

Wayne enjoys the great outdoors; he is an avid boater and enjoys the beach life and water skiing with family and friends. He has a great sense of humor and can keep you laughing all day!

EDUCATION & CREDENTIALSUniversity of Central Florida, Business Administration, 1995

Sean D. Casterline

Sean D. Casterline, a Chartered Financial Analyst (CFA), is a recognized expert in the field of wealth management and alternative investments. As founder of Delta Capital Management, LLC, Sean specializes in the areas of corporate finance and alternative real estate transactions for clients across a wide variety of industries.

Mr. Casterline earned both his bachelor’s degree in Finance and master’s degree in Business Administration from the University of Florida. He also has the distinction of being a CFA Charter holder and was an Arbitrator for the NASD. Mr. Casterline is an active member at the University of Florida Alumni Association and has also served as a Director for the CFA-Orlando Society. He has been involved with other charitable organizations such as the Fellowship of Christian Athletes, Big Brothers/Big Sisters of Gainesville, and Habitat for Humanity.

Anthony DeLuca

Anthony Deluca is a recognized expert in the field of wealth management and alternative investments. As a Principal and Wealth Manager for Delta Capital Management, Anthony is integral to the money management process. Anthony also sits on the company’s investment committee that oversees company investment direction for over $350 million in assets. Anthony also has a passion for real estate and specializes in the areas of corporate finance and alternative real estate transactions for clients across a wide variety of industries. In recent years, he has worked to develop investment and financing alternatives using the broadest range of financing structures available to maximize yields and flexibility for his clients. Graduating Summa Cum Laude, Anthony earned both a Geoscience degree and a Geographical Information Systems certificate at Florida Atlantic University while playing Division 1 College Football for three years. Anthony made his transition into the Financial Services Industry after spending the first part of his career in the world of Civil Engineering. He has held several security licenses including the Series 65 – National RIA, the Series 7 – General Securities Representative, the Health, Life, and Variable Annuity License as well as the General Securities Principal License – Series 24. He passed the CFP® examination and is the process of registering for the CFP® designation. Outside of the office, Anthony is an avid sports fan and competes in tennis, lacrosse, and field hockey. He is also part of the Seminole County Leadership Group, Class of 32. Anthony currently lives in Orlando with his girlfriend, Indigo, and their adopted Doberman, Rebel

Alexander Petsos

Alexander Petsos serves as Manager of Investment Operations for Storage Units and its affiliates. Alex is also a financial advisor and portfolio manager with Delta Capital Management, LLC. He has managed accounts for a variety of individuals and businesses across the United States.

Prior to joining the Storage Units team, Alex worked with global investment funds at Bank of New York Mellon and honed his analytical abilities as a financial analyst with a Fortune Global 500 company. He has passed the Series 65 Uniform Investment Advisor Law Exam and is currently enrolled in the Chartered Financial Analyst (CFA) program.

Alex has a Master of Business Administration concentrating in finance from the Crummer Graduate School of Business at Rollins College in Winter Park, FL, where he graduated with honors. He also has a Bachelor’s Degree in economics from Rollins College, graduating with honors.

The StorageUnits Team

All self-storage is not built the same. StorageUnits state-of-the-art facilities offer quality features to bring renters an upscale self-storage experience.

At StorageUnits, they know how important a trustworthy, secure, and well-maintained facility is. With a friendly management team, access 7 days a week, and temperature-controlled unit options for those extra-delicate items, the company offers dependable storage solutions that renters can count on.

That equates to over a billion dollars of self-storage communities built by our development/construction team, spanning over 23 states.

Regardless of the strategy or geographic location, our investment philosophy is guided by two overarching principles:

- Our investors always come first.

- Experience and strong asset management drive performance in the self-storage sector

WANT TO 1031 INTO OUR SELF-STORAGE FUND?

Want to learn more about the fund?

Let us help you discover how it can boost your financial portfolio and provide passive income during recessions. Schedule your free investor Introductory session today and take the first step towards financial freedom.