Self-Storage Unsophisticated & Undermanaged

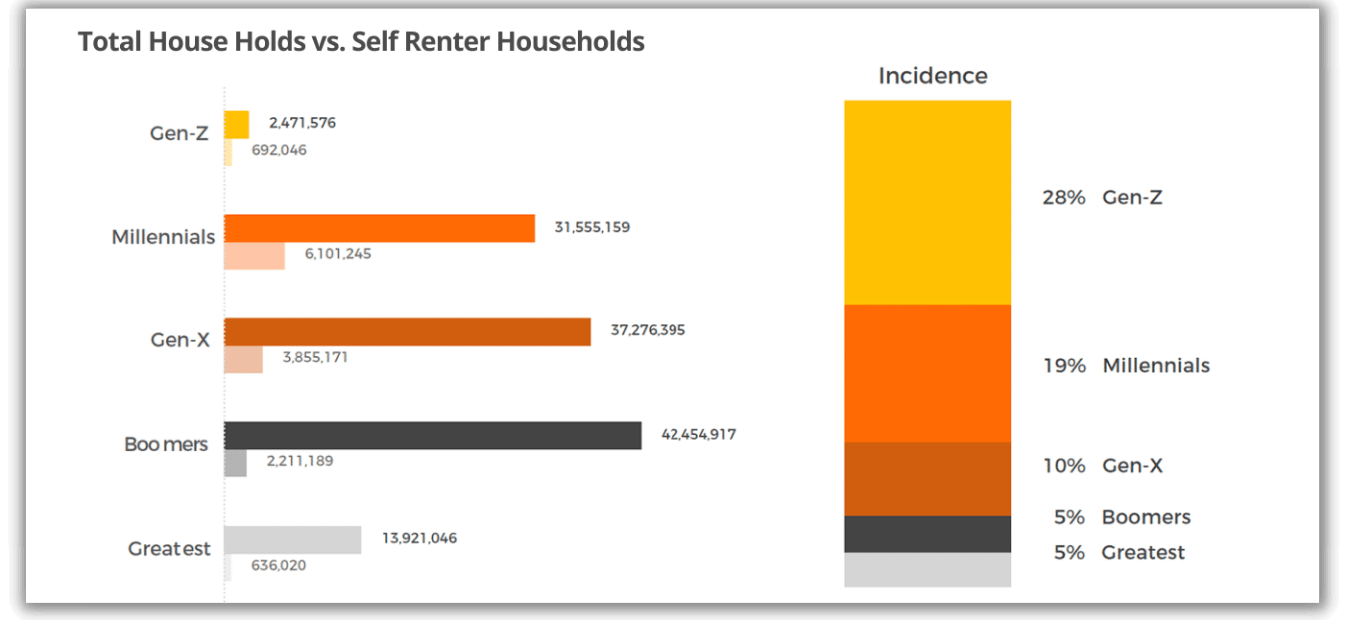

Self-storage is a fractionalized industry that creates a very real opportunity for investors. The highly fragmented marketplace lacks a sophisticated operations platform and dynamic revenue management. Property values are eroded by below-market rents, bloated expense loads, and poor customer experiences.

74%

of Facilities are Owned by Small,Unsophisticated Operators

StorageUnits is built to take advantage of this industry fractionalization through a stronger brand defined by

Onsite Management Teams

Electronic Gate Access

Digital Security Surveillance Monitoring

Well-lit Corridors

Lack of Institutional Competition Drives Opportunity

Institutional buyers are primarily focused on large portfolio acquisitions and ground-up development. Many are not configured to grow a portfolio of operating facilities organically, potentially providing an opportunity for private investors.

A Vertical Story

Unlike many general contractors, the combination of Storage Units and Rapid Building Solutions has expertise across all phases of development, construction, and operations. The company can provide all the necessary services under one roof. This allows the self-storage experts at StorageUnits to reduce unnecessary expenses and avoid unforeseen delays that typically occur when dealing with several consultants at once.